Ask anyone moving to Austin this year, and they’ll tell you: the mortgage doesn’t shock them as much as the tax bill. Across Texas, property taxes carry a weight unlike many other states—and newcomers arriving in Austin during September 2025 keep learning that lesson firsthand.

What makes Texas stand apart? It’s not just the rate on paper. It’s the cultural framework, constitutional design, and absence of state income tax that shift the finance of civic life onto property owners. Rents, mortgages, even school decisions—all ripple outward from a tax system often described as opaque, occasionally controversial, but undeniably Texan.

The Texas Tax Character

Unlike states with balanced taxation across income, sales, and property, Texas spared workers the bite of income tax. Instead, counties shoulder the load through property taxes. This creates three immediate distinctions newcomers notice:

- Higher Rates Than National Average

U.S. median property tax effective rate in 2025 is 1.04% of home value. Texas consistently ranks near double at ~1.75–1.95% depending on county. - Fragmented Jurisdictions

One home experiences rates from five or more taxing entities: city, county, hospital districts, school districts, and community colleges. - Perennially High Political Heat

Election seasons in Texas often turn on tax relief promises, pushing proposed reforms to the center stage every two years.

Data Snapshot: Comparing 2025 Rates

| Jurisdiction/State | Avg Effective Rate (2025) | Median Home Value | Est. Annual Bill |

|---|---|---|---|

| Texas | 1.81% | $343,000 | $6,210 |

| U.S. Average | 1.04% | $348,000 | $3,619 |

| California | 0.76% | $689,000 | $5,236 |

| Florida | 0.93% | $377,000 | $3,506 |

| Illinois | 2.05% | $255,000 | $5,228 |

This stark comparison tells the story: a Texas middle‑class homeowner shoulders far heavier levies than peers in California or Florida—even if those states have higher purchase prices.

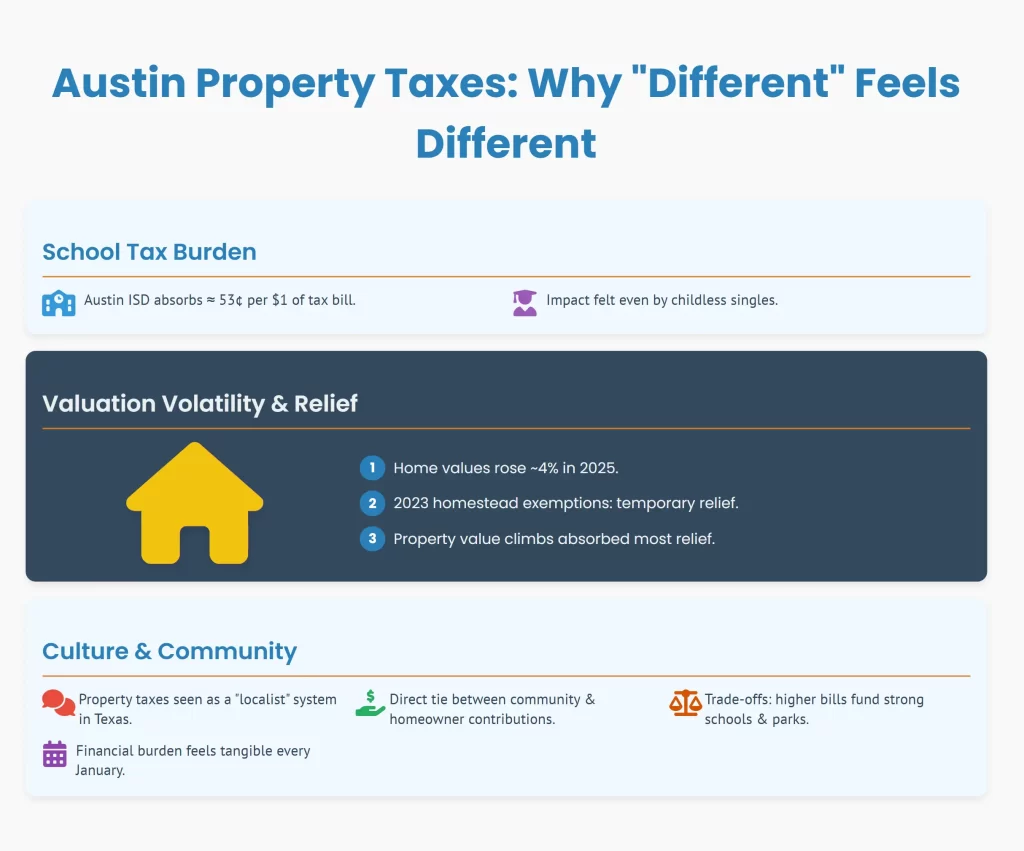

Why “Different” Feels Different in Austin

- School‑Heavy Burden

Austin ISD absorbs the lion’s share of each bill (≈ 53 cents per $1). Even childless singles feel this impact. - Valuation Volatility

Rapid home appreciation creates large jumps in taxable value. Travis County appraisals rose an average 4% in 2025, milder than previous years yet still meaningful. - Relief Attempts

New homestead exemptions implemented in 2023 brought temporary breathing space, but as property values climbed, much of relief got absorbed.

Culture Plays a Role

Numbers don’t capture the full picture. Texans have long seen property taxes as a “localist” system—a direct tie between community strength and local homeowner contributions. In Austin, residents wrestle with trade‑offs: higher bills fund strong schools, eclectic park systems, and responsive infrastructure, but the personal financial burden feels tangible every January.

It’s why so many families pore over guides like the Austin Neighborhood Deep Dive to understand not only home styles, but also which districts carry tax rates worth shouldering against lifestyle benefits.

See the widely used Austin Neighborhoods Guide here.

Homeowner Tips for Managing the Burden

- Appeal Annually: In Travis County, roughly 28% of appeals succeed. Check each spring whether valuation overshot reality.

- Audit Exemptions: Confirm homestead, senior, or veteran exemptions remain applied.

- Schedule Payments: Average Austin property tax payments run ~$678/month equivalent. Breaking into escrow installments avoids lump‑sum stress.

Support yourself pragmatically too. Keep tax paperwork in order using fireproof document safes, and use calendar‑reminder apps or wall planners to never miss payment cycles.

Long‑View Dynamics

Looking ahead, analysts expect:

- 2026 Forecast: Rates hold steady at ~1.8%.

- Housing Stock: More multi‑family builds may help tame appraisals.

- Policy Pulse: Renewed legislative pressure for appraisal caps under debate in the coming session.

Why This Matters to Renters Too

You might say, “I rent, so what’s it to me?” Yet property taxes flow into rent as landlords pass along increases. 2025 rent stabilization in Austin was partly tied to cooling appraisals. Should rates rise again, expect monthly rents to echo the pattern months later.

Check CityMoveGuide’s Austin rental trend coverage for how this interplay affects everyday renters.

Final Perspective

Taxes in Austin don’t just write checks to government accounts. They shape neighborhoods, determine local school strength, and ripple through rent markets. What makes them feel different is the concentration: Texans pay less in income tax, yes, but they feel the bill carved sharply into their housing costs.

When you weigh a home or lease decision, see taxes not as numbers in isolation but as the invisible architecture shaping your civic landscape. That realization allows you to choose neighborhoods aligned with your priorities—and that decision becomes not just financial, but profoundly personal.

To process those trade‑offs wisely, thousands tap into resources that unpack both numbers and lived realities. The comprehensive Austin Neighborhoods Guide pairs perfectly with the Moving to Austin overview and Best Neighborhoods analysis. The blend grounds you in both data and daily life.