Property taxes rarely inspire excitement, yet they echo through every home search and every budget sheet. In Texas, where the absence of a state income tax shifts more weight onto property levies, understanding how to project your own bill becomes indispensable. In Austin this September 2025, updated tax rates, market valuations, and exemptions create a landscape every homeowner, or would‑be homeowner, needs to explore before setting down roots.

Whether you’re buying your first condo along Rainey Street, considering a family house in Round Rock, or evaluating investment property in East Austin, this tutorial guides you in estimating your property tax liability with clarity.

What Property Taxes Look Like in Austin, 2025

Central Texans lean heavily on county appraisal values. In Travis County (home to Austin proper), the overall average tax rate remains about 1.81% of assessed value. This number fluctuates when you weave in city, county, school district, and special district levies.

| Jurisdiction (2025 Rates) | Rate (per $100 valuation) | Notes |

|---|---|---|

| Travis County | 0.3542 | Funding general operations |

| City of Austin | 0.4356 | City services |

| Austin ISD (schools) | 0.9623 | Largest single slice |

| Healthcare District | 0.1114 | Hospital system, clinics |

| Austin Community College | 0.098 | Voter‑approved educational support |

| Combined Average | 1.81% | Most homeowners align here |

In Williamson County (covering north suburbs like Round Rock, Cedar Park), rates hover closer to 1.94%, while Hays County averages 1.75%.

Estimating Your Own Bill

The calculation is a simple formula:

Assessed Value x Tax Rate = Estimated Bill

Example:

- Home appraisal: $450,000

- Combined area rate: 1.81%

- Estimated annual tax = $8,145 (or ~$678/month)

For a $600,000 central Austin home at 1.81%, property taxes crest $10,860 annually.

The Homestead Exemption Advantage

It’s not all burden. In 2025, the Texas homestead exemption sits at $40,000 for school districts and $25,000 for city/county portions.

Meaning:

- A $450,000 home taxed with a $65,000 reduction → taxable base = $385,000.

- Effective monthly bill cut by ~$100.

If you’re a senior (65+) or qualifying disabled homeowner, additional exemptions stack further, trimming thousands.

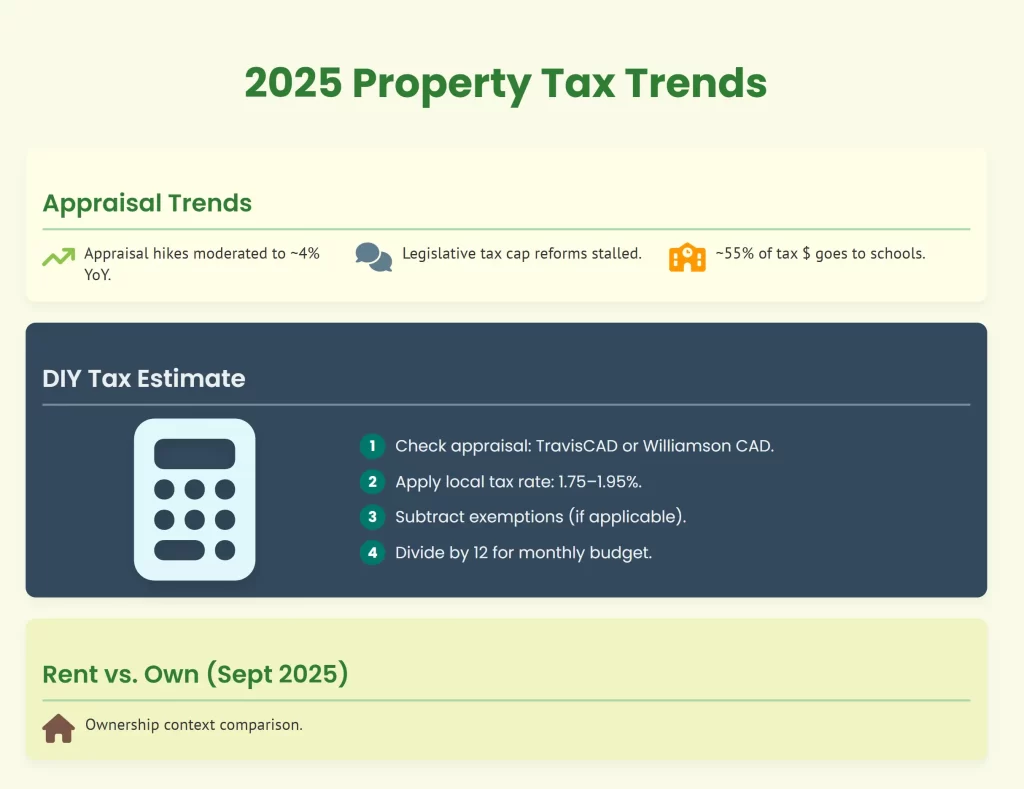

Trends in 2025: What Factors to Watch

- Appraisals Rising Slower: Compared to the soaring valuations of 2021–22, appraisal hikes moderated in 2025 to an average 4% increase year‑over‑year.

- Relief on the Table: Legislative chatter continues in Austin about caps on yearly tax increases, but no new reforms passed as of September.

- School District Burden: Nearly 55% of every dollar goes to schools, making education policy debates deeply tied to property tax outcomes.

Practical Tutorial Workflow

- Check Current Appraisal

Visit TravisCAD.org or Williamson CAD depending on where you live. Search by property address to confirm market value. - Apply Rate Table

Multiply assessed value by local combined tax rate (1.75–1.95%). - Subtract Exemptions

Apply homestead, senior, or veteran deductions where applicable. - Divide Annually → Monthly

Spread across 12 months for realistic budgeting.

Affordability Context for Renters Considering Ownership

Here’s how ownership compares to continued renting (Sept 2025):

| Scenario | Monthly Rent (2BR avg) | Monthly Taxes on $450k home | Difference |

|---|---|---|---|

| Renting in Austin | $1,850 | – | – |

| Owning in Austin | – | ~$678 | $678 on top of mortgage/insurance |

For renters dreaming of ownership, property taxes are the “hidden mortgage partner”—and ignoring them up front risks misjudging long‑term costs. For a deep dive into housing alternatives, check the Rent vs Buy discussion here.

Tools and Supplies for Homeowners

Practicality matters. Budgeting with spreadsheets helps, but physical tools matter too:

- Filing cabinets handle yearly tax statements without clutter. Try modular steel filing cabinets.

- Document scanners keep paperless records essential if appealing valuations.

- Ledger notebooks may seem old‑school, but many locals prefer handwritten clarity.

Why Neighborhood Still Shapes the Bill

Crestview vs Circle C Ranch. Pflugerville vs East Riverside. Identical homes rarely share identical outcomes. Certain school district boundaries tack hundreds more onto property bills. That’s why relocation specialists often emphasize: it’s less about listing price, more about total ongoing cost.

When weighing where to buy, lean on a detailed Austin neighborhood guide relied upon by long‑term residents to capture the dynamics behind both mortgage and tax numbers.

Find the Austin Neighborhoods Guide here.

Future Glimpse: 2026 Outlook

- Rate Stability: Analysts expect 2026 combined rates to fluctuate within ±0.05%.

- Housing Inventory: More projects in pipeline could push appraisal growth slower.

- Legislation: Watch 2026 Texas legislative session for renewed homestead exemption debates.

Bringing the Tutorial Back to You

Taxes may be numbers, but their effect is emotional. They shape your monthly peace of mind, the schools your kids attend, and the rhythm of your long‑range budget. Walking calmly through the workflow you can run the math yourself—instead of relying on surprises in escrow.

Pair it with internal context provided in guides like:

With clarity, ownership in Austin stops being a puzzle and starts being grounded reality.